Everything about Feie Calculator

Wiki Article

Feie Calculator Can Be Fun For Everyone

Table of ContentsAn Unbiased View of Feie CalculatorFeie Calculator Fundamentals ExplainedAn Unbiased View of Feie CalculatorThe Main Principles Of Feie Calculator The Best Strategy To Use For Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his wife to aid satisfy the Bona Fide Residency Examination. Neil aims out that buying building abroad can be testing without first experiencing the location."It's something that individuals need to be really thorough about," he claims, and encourages deportees to be cautious of typical mistakes, such as overstaying in the United state

Neil is careful to cautious to U.S. tax authorities that "I'm not conducting any performing any type of Service. The U.S. is one of the few countries that tax obligations its citizens regardless of where they live, implying that also if a deportee has no income from U.S.

tax return. "The Foreign Tax Credit scores enables individuals working in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the amount they've already paid in taxes abroad," states Lewis.

The Best Strategy To Use For Feie Calculator

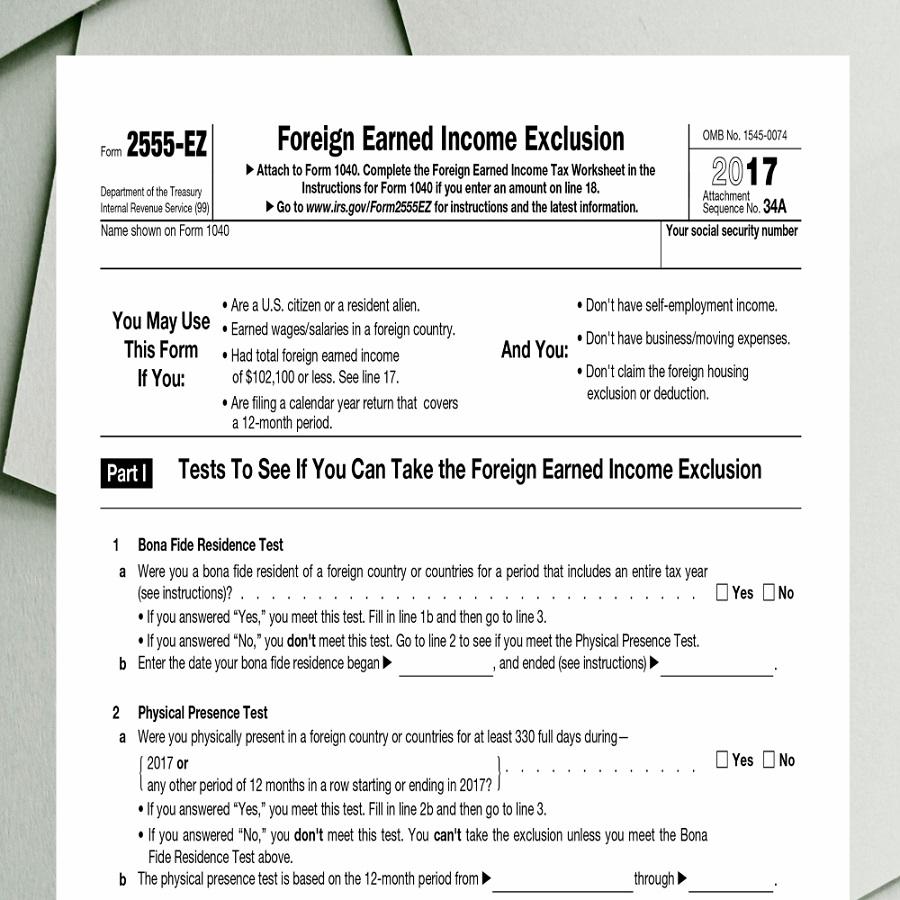

Below are some of the most frequently asked concerns concerning the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) permits U.S. taxpayers to exclude up to $130,000 of foreign-earned income from government income tax obligation, reducing their united state tax obligation responsibility. To get FEIE, you should meet either the Physical Presence Examination (330 days abroad) or the Authentic House Test (verify your main residence in an international nation for a whole tax obligation year).

The Physical Visibility Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Examination likewise requires united state taxpayers to have both a foreign revenue and an international tax obligation home. A tax home is defined as your prime location for company or work, despite your family members's house.

Indicators on Feie Calculator You Should Know

A revenue tax treaty between the united state and another country can help prevent dual taxes. While the Foreign Earned Income Exclusion decreases taxed earnings, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Report) is a needed declare united state residents with over $10,000 in foreign economic accounts.Eligibility for FEIE depends on conference details residency or physical presence tests. He has over thirty years of experience and now specializes in CFO solutions, equity compensation, copyright tax, cannabis taxation and divorce related tax/financial planning issues. He is a deportee based in Mexico.

The international earned income exclusions, in some cases referred to as the Sec. 911 exclusions, leave out tax on wages earned from working abroad. The exemptions consist of 2 parts - an income exclusion and a real estate exemption. The adhering to Frequently asked questions discuss pop over to this site the benefit of the exclusions including when both spouses are expats in a basic fashion.

All about Feie Calculator

The income exclusion is currently indexed for rising cost of living. The maximum yearly income exclusion is $130,000 for 2025. The tax benefit leaves out the earnings from tax at lower tax rates. Previously, the exemptions "came off the top" minimizing income subject to tax obligation on top tax obligation rates. The exemptions may or may not reduce earnings used for various other purposes, such as individual retirement account limits, youngster debts, personal exceptions, and so on.These exclusions do not spare the salaries from United States taxation however merely supply a tax decrease. Keep in mind that a single person working abroad for all of 2025 that gained about $145,000 without any other revenue will have gross income lowered to absolutely no - properly the exact same answer as being "free of tax." The exemptions are calculated daily.

Report this wiki page